Support

Donating to the Kellogg-Hubbard Library is a great way to support your community. Each gift helps us to provide free and equal access to materials, resources, programs, and a welcoming space for all community members to enjoy.

Quick Links

Why give?

1. Your gift will make a real impact in Montpelier and the surrounding communities.

The KHL service area has a population of over 18,000. Thanks to the generous support of our donors, KHL is able to keep essential services and programs free and accessible to all community members year-round.

2. You’re helping to empower your fellow community members to become lifelong learners.

Supporting KHL means you understand the importance of easy access to materials, online resources, educational programs, and a welcoming place.

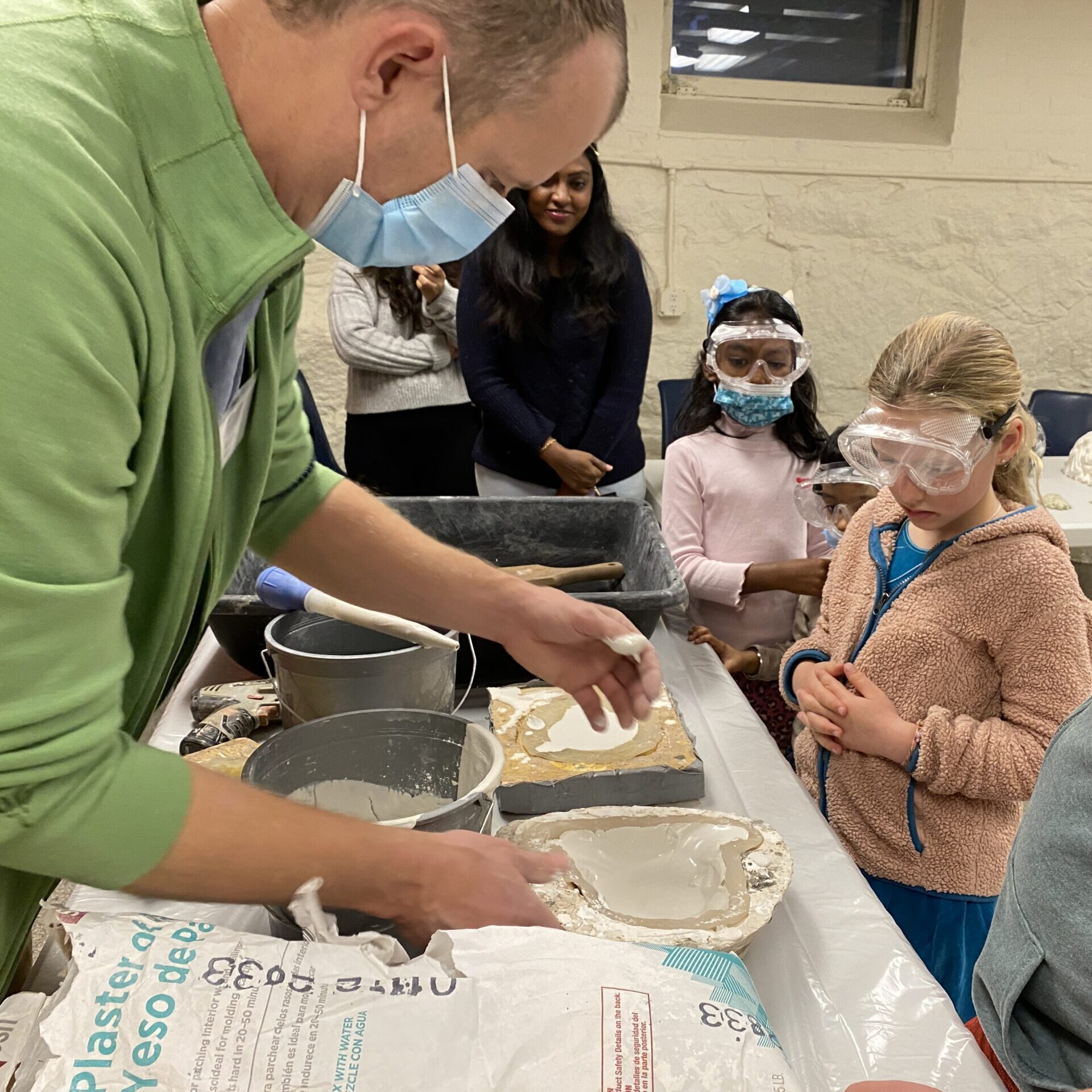

3. KHL is committed to being a resilient, inclusive, and innovative library.

The needs of our communities are constantly changing, as we saw with the COVID-19 pandemic and the 2023 flood. Your donation will ensure that we can provide services beyond traditional books, such as e-books, audiobooks, museum passes, and online classes.

4. Unlike many other libraries, KHL is a 501c3 non-profit, which means nearly 50% of our funding comes from the generosity of donors like you.

The Library provides access to a massive amount of information and entertainment completely free of charge to our patrons. Imagine in the last year you’ve borrowed five books, eight eBooks, three magazines, and six movies. Say you also attended one of our programs (virtual or in-person), borrowed one of our museum passes, and ordered a book through inter-library loan. The value of these items and services is over $300, or $25/month!

Looking for a meaningful amount to give?

Explore this Library Value Calculator to discover how much money you save by using the library. Consider contributing a portion of this value to support the community’s access to knowledge and resources.

Ways to Give and Support

Make a gift online

The easiest way to support the library today is by making a gift right now here on our website.

Your gift will help to empower our community members to be lifelong learners through the library’s accessible services and programs.

Become a KHL Sustainer

KHL Sustainers are our monthly donors who have made a commitment to supporting the library year-round.

These donors ensure that library services will remain free and accessible for everyone. Select a recurring donation on our donation page to become a KHL Sustainer and we’ll send you a special sticker with our thanks.

Plan a Legacy Gift

By making a legacy gift, you are ensuring future generations will find value and joy in the Kellogg-Hubbard Library.

Bequests, retirement assets, charitable gift annuities and charitable remainder trusts are all way to support Kellogg-Hubbard Library

Volunteer

The library is always on the lookout for helping hands.

We have many opportunities for volunteers to pitch in including shelving and processing materials, helping with outreach, and in our year-round book sale.

Other Ways to Give

Donate by Check

Checks should be made out to Kellogg-Hubbard Library and mailed to:

Development

Kellogg-Hubbard Library

135 Main Street

Montpelier, VT 05602

Or, if you would prefer, you can bring your check to the library and hand it to one of our librarians at the Main Circulation Desk.

Donor-advised Fund

A donor-advised fund (DAF) is like a charity savings account. You, or a group, put money into this account to give to charities later. When you put money in, you get a tax break. You can then suggest which charities should receive the money from your account. It’s a great way to plan and organize your charitable giving.

To make a gift to KHL through your DAF, contact your fund manager and recommend a grant to the Kellogg-Hubbard Library. Click here to access our tax information.

You can even set up recurring grants to the library from your DAF to help sustain the library’s programs and services.

IRA Rollover or Qualified Charitable Distribution

If you are 70 ½ or older, you can give to the library from your individual retirement account (IRA). This option can maximize your charitable giving while minimizing your taxable income.

Contact your IRA plan administrator to start the distribution process. Click here to access our tax information.

After you have started the distribution process, let us know so that we can ensure we receive your gift. Contact Dan Groberg at 802-223-3338 or by email at dgroberg@kellogghubbard.org with the following information:

- Your name

- Gift amount

- Anticipated date of check arrival

- Name of IRA Custodian

- How you would like your gift to be used (unrestricted or restricted)

Stocks & Bonds

Transfer ownership of appreciated stocks or bonds as a gift to the Kellogg-Hubbard Library. Your gift of appreciated holdings will be fully deductible and valued at the current fair market value, saving you capital gains taxes that would otherwise have been incurred.

Contact your IRA plan administrator to start the distribution process. Here is the info you will need:

KHL’s broker: Charles Schwab

Account name: Kellogg-Hubbard Library

Account number: 8973-4817

DTC number: 0164

Address: 135 Main Street, Montpelier, VT 05602

Tax ID number: 03-0181056

After you have started the transfer process, let us know so that we can ensure we receive your gift. Contact Dan Groberg at 802-223-3338 or by email at dgroberg@kellogghubbard.org with the following information:

- Your name

- Approximate gift amount (the deductible amount of your gift will be determined by the average share value on the day of the transaction).

- Anticipated transaction date

- Name of stocks

- How you would like your gift to be used (unrestricted or restricted)

If your holdings have depreciated, consider selling them, take the loss on your taxes, and donate the cash proceeds to the Library.

Solar Credits

If you have solar panels, you likely receive credits for the extra energy your panels produce. Consider gifting these credits to the Kellogg-Hubbard Library. This donation will help the library save money on our energy bills so more of our funds can go towards our services and programming.

In-kind donation to the KHL Book Sale

The KHL Book Sale, located in the Reading Room, is our year-round fundraiser where you can buy used books, audiobooks, CDs, and DVDs, all at a bargain price.

In addition to shopping the sale, you can also help us stock it! Click here to learn more about donating your gently used books and more to the book sale.

All proceeds from the book sale go toward supporting the library’s services and programming.

Business Sponsorship

By sponsoring a KHL event or programming, you are demonstrating your business’ commitment to supporting the Central Vermont community. This partnership will help you to meet your marketing and social responsibility goals while ensuring that all community members have equal access to information, resources, and a safe space to gather and connect.

Workplace Giving

Many companies offer an employee giving program in which you can support the library with a payroll deduction or have your employer match your donation to double your impact. Contact your Corporate Social Responsibility or Human Resources department to determine if this is an option for you.

Purchase KHL Merchandise

Show your love for KHL with some fun library merchandise! We have a variety of stickers and postcards available, as well as a tote bag and mug. All proceeds support the library’s programming and services. Visit the Main Circulation Desk to shop!

Tax Information

Please use the following legal name and tax identification:

Kellogg-Hubbard Library

135 Main St.

Montpelier, VT 05602

Tax ID Number: 03-0181056

The Kellogg-Hubbard Library is an IRS 501(c)(3) tax-exempt organization and your donation is tax-deductible within the guidelines of U.S. law.